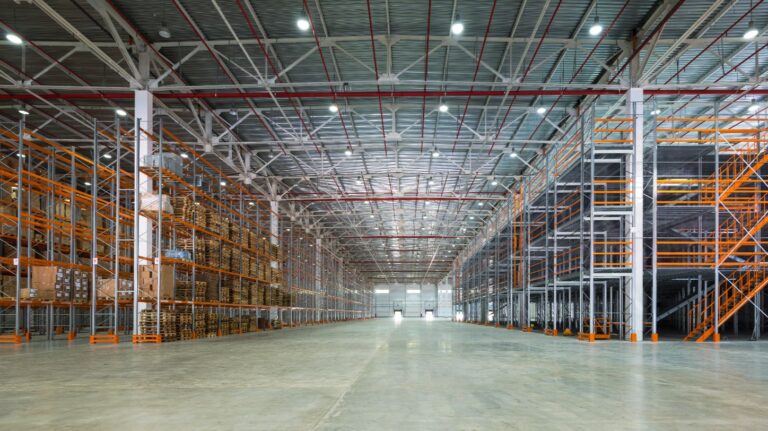

Property adviser Knight Frank has published its latest industrial Future Gazing report, stating that the average clear height of UK warehouses (over 20,000ft²) has risen by over 50% from 7.6m to 11.5m over the past 20 years.

Reportedly, the rise is partially driven by the growth of ecommerce and the need for managing larger inventories with greater efficiency, and is enabled by improvements in warehouse automation.

Knight Frank also stated that the push toward taller warehouses is due in large part to occupiers’ need to minimise costs while maximising operational efficiency.

As land and labour costs continue to rise and automation becomes more affordable, the economic case for building upwards rather than outwards strengthens.

Automation was identified as a great enabler for utilising greater clear heights, with technology such as Automated Storage and Retrieval Systems (AS/RS), Autonomous Mobile Robots (AMRs), and Automated Guided Vehicles (AGVs) making such use feasible.

The report also outlines that labour costs have risen and have been driven to continue to do so by an increased national minimum wage and employer national insurance contributions.

For example, the salary and tax costs of employing a 21-year-old on minimum wage (working 35 hours a week) has increased 61% over the past five years.

This, the report outlines, supports the case for adopting automation systems within warehouses and, by extension, embracing taller structures, to alleviate expenditure challenges.

Additionally, the shift to online retail has changed how goods are stored and processed, with warehouses used for order fulfilment and not just bulk pallet storage.

Mintel forecast online retail sales to rise from £125 billion in 2024 to around £151bn by 2030 which, according to Knight Frank analysis, translates to an additional 35 million ft² of UK warehousing requirements.

However, operators are increasingly opting for taller buildings, and this could alter the relationship between online spend and floorspace, reducing projections for future floorspace demand as operators make more efficient use of vertical space.

Accounting for a 25% or greater increase in clear heights (excluding last mile units) by 2030, the amount of additional floorspace needed would reduce to around 28 million ft².

Partner at Knight Frank Johnny Hawkins, said: “Height is increasingly a defining feature of logistics facilities, playing a key role in driving value and performance.

“For investors, taller buildings can improve income resilience, support long-term value growth and reduce obsolescence risk.

“Those who integrate vertical thinking into their investment, development, and operational decision-making will be best placed to mitigate cost increases and land availability challenges, as well as capitalising on the opportunities presented by a warehouse market that trends increasingly skyward.”